All Publications

Publications Filters

CLC launches new animal tracking training package at ranger camp

April 14th, 2024

Type:

Media Release

Submission to the Senate Select Committee on Cost of Living

April 11th, 2024

Type:

Submissions & Reports

Submission on new ‘Nature Positive’ laws (EPBC Act reform) (Oct and Dec 2023 consultation materials)

April 3rd, 2024

Type:

Submissions & Reports

Climate change: Learning about what is happening with the weather in central Australia

March 13th, 2024

Type:

Other

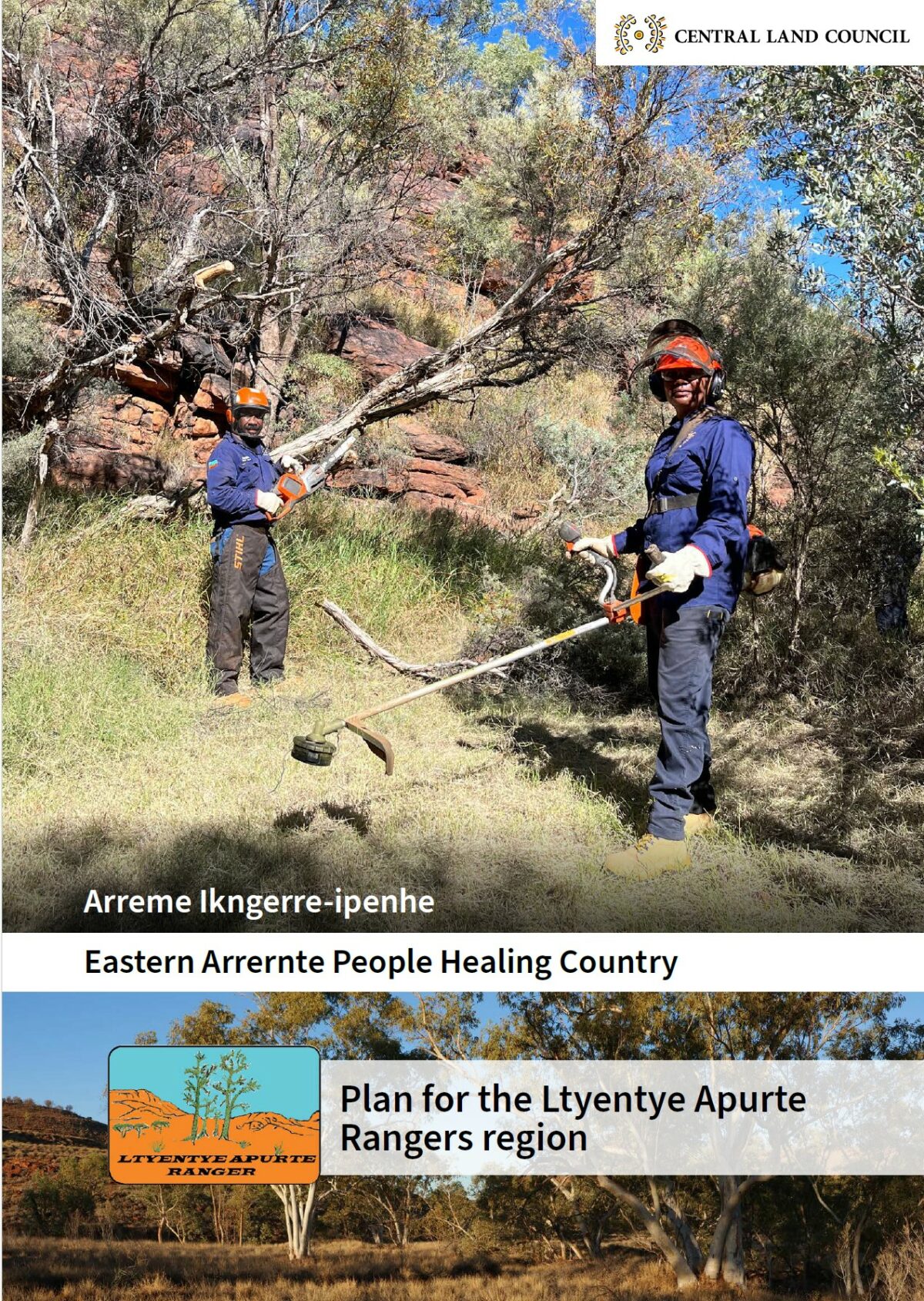

Muru-Warinyi Ankkul Rangers Healthy Country Plan 2021-2031

March 12th, 2024

Type:

Land Management Plans

CLC welcomes unprecedented investment in remote community houses

March 12th, 2024

Type:

Media Release

Submission on the First Nations Clean Energy Strategy

March 5th, 2024

Type:

Submissions & Reports